The Farmer Who Predicted 100 Years of Market Cycles: Lessons From Samuel Brenner

When we think of financial forecasting, the image that comes to mind is modern-day analysts armed with AI tools, algorithmic trading systems, and endless streams of economic data. But in the late 1800s, a farmer with no formal training in economics made a bold claim: markets move in predictable cycles and he mapped them out for the next century. His name was Samuel Brenner, and his story offers both a fascinating look at financial history and timeless lessons for investors navigating uncertainty today.

Samuel Brenner lived during a period of rapid industrialization in the United States. But the prosperity of the era came crashing down in 1873, when a major financial panic swept through the country. Banks failed, railroads collapsed, and millions of ordinary citizens saw their wealth destroyed.

Brenner himself was hit hard. Rather than walking away, he became obsessed with finding answers. Why did markets crash so suddenly? Were these downturns random, or did they follow hidden patterns? His pursuit of these questions led him to develop one of the earliest documented frameworks of economic cycles.

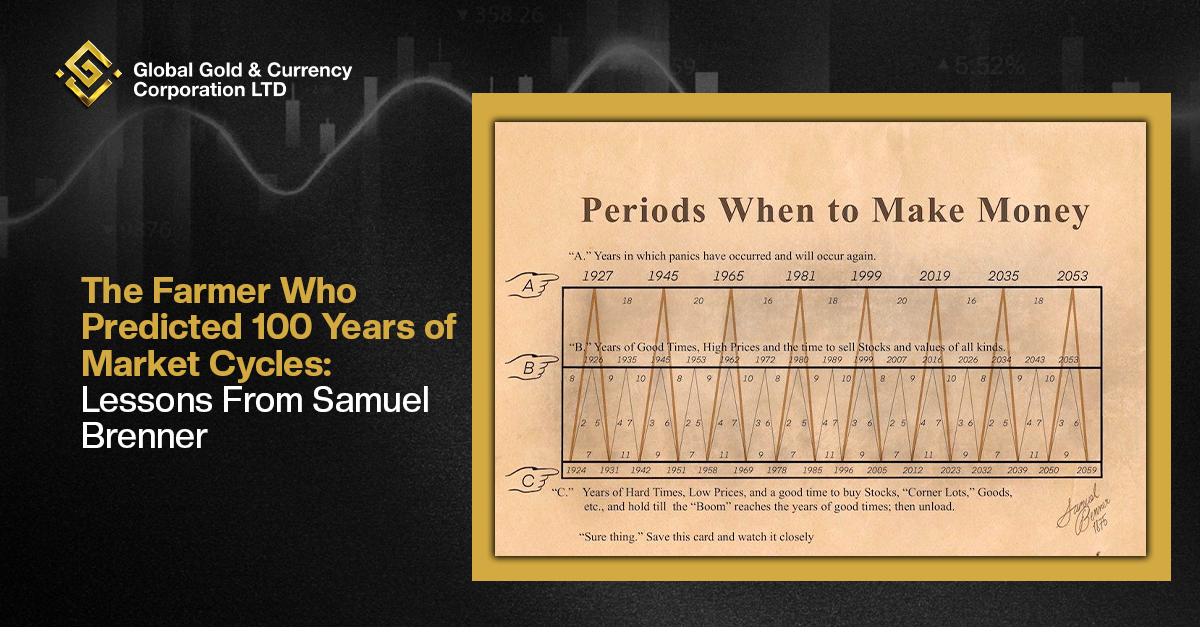

In 1875, Brenner published his findings in a book titled “Brenner’s Prophecies: Future Ups and Downs in Prices.” In it, he outlined three repeating phases that he believed defined financial markets:

1. Panic Years – Periods of crisis, where speculation unwound, credit tightened, and panic selling dominated.

2. Good Times – Years of prosperity, rising prices, and booming business activity. Brenner advised these were ideal periods to sell or reduce exposure.

3. Difficult Times – Years of stagnation, contraction, and low prices. Brenner believed these were not years to fear, but rather opportunities to accumulate assets cheaply.

This framework bears a striking resemblance to what modern economists now call the business cycle—expansion, peak, contraction, and trough. But Brenner discovered it decades before the term became mainstream in academic economics.

Brenner’s insights didn’t come from textbooks. They came from his life as a farmer.

- He noticed that agricultural cycles, particularly in pig farming and corn harvests, seemed to follow recurring patterns.

- He tied these cycles to the 11-year solar cycle, noting that sunspot activity influenced weather patterns. Periods of increased sunspot activity often led to droughts, crop failures, and rising food prices, while quiet cycles aligned with better harvests and lower food prices.

- Since food and commodities were central to the 19th-century economy, fluctuations in crops rippled outward into financial markets, trade, and even banking stability.

In short, Brenner was one of the first to argue that climate and nature directly impact economic cycles. Today, we’d call this an early form of “cross-disciplinary analysis.”

Skeptics dismissed Brenner at first. But over time, his predictions gained credibility because many of his projected “Panic Years” coincided with real-world financial crises.

- 1873 – Panic of 1873 triggered by overbuilding of railroads and bank failures.

- 1893 – Major U.S. depression marked by stock market collapse and high unemployment.

- 1929 – The Wall Street Crash that led to the Great Depression.

- 1973 – The oil crisis and global recession.

While not every cycle aligned perfectly, the rhythm of recurring crises every 8–11 years was hard to ignore. Investors, traders, and even economists began referencing his work as an early roadmap for understanding market behavior.

Fast forward to 2025, and Brenner’s lessons remain surprisingly relevant:

- Cycles Are Natural: Markets are not linear. They expand, peak, contract, and reset. This is as true today with tech stocks and crypto as it was with railroads and corn.

- Human Behavior Drives Patterns: Greed and fear ensure markets will always overextend and then correct.

- Nature Still Plays a Role: From droughts disrupting crop yields to climate change affecting supply chains, natural cycles still influence economies today.

- The Best Opportunities Appear in “Difficult Times”: Brenner’s advice to buy when prices are low and pessimism is high mirrors Warren Buffett’s famous mantra: “Be fearful when others are greedy, and greedy when others are fearful.”

- Brenner, Samuel. Brenner’s Prophecies: Future Ups and Downs in Prices (1875).

- U.S. National Bureau of Economic Research (NBER) – Historical Business Cycles Data.

- NASA – Solar Cycle & Sunspot Activity Research.

- Asymmetric Finance – Meet the Farmer Who Predicted 100 Years of Market Cycles.

- Federal Reserve History – The Panic of 1873 and the Long Depression.

Brenner’s story isn’t just a piece of financial history, it’s a guidebook for modern decision-making.

1. Respect Long-Term Cycles: Investors should recognize that bull markets don’t last forever, and downturns aren’t permanent. Planning for cycles helps reduce emotional decision-making.

2.Diversify Across Sectors: Just as crop cycles impacted 19th-century markets, today’s shocks may come from energy prices, geopolitical risks, or technology disruptions. Diversification cushions against these shocks.

3. Look Beyond Traditional Indicators: Brenner used farming and weather cycles. Today, forward-thinking investors may find insights in climate data, demographic shifts, or even AI adoption curves.

4. Turn Downturns Into Opportunities: Market corrections and recessions often offer the best entry points for long-term gains. Brenner’s “Difficult Times” were not warnings, but invitations to prepare for the next upswing.

While we may now rely on algorithms, central banks, and global economic models, Brenner’s simple observations from the fields of corn and pigs remind us that forecasting is not just about data, it’s about patterns, patience, and perspective.

Sometimes, the greatest financial insights don’t come from Wall Street they come from the soil beneath our feet and the cycles of the sun above us.

Sources