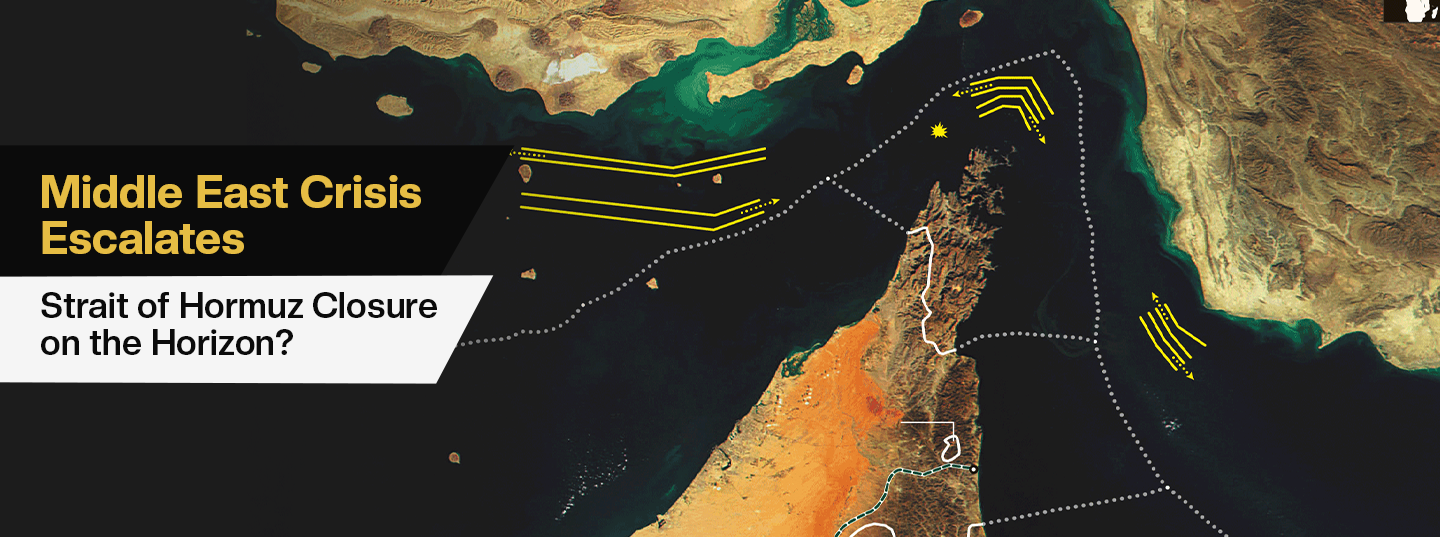

1. Middle East Crisis Escalates: Strait of Hormuz Closure on the Horizon?

Tensions between Iran and Israel have pushed the Middle East back into global focus, as Iran’s parliament approves a bill to close the Strait of Hormuz — a chokepoint for 20 million barrels/day, or 20% of global oil trade. Final approval now rests with Iran’s Supreme Leader.

Why the Strait of Hormuz Matters

The Strait of Hormuz connects the Persian Gulf to global markets. Major exporters — Saudi Arabia, Iraq, UAE, Kuwait, Qatar, and Iran — ship over 90% of their oil through it. With just 7 million b/d in pipeline capacity available elsewhere, 65% of Gulf exports are vulnerable.

Market Implications: Oil, Inflation & Volatility

Oil has already jumped +35% since April, and this news could drive prices much higher.

JPMorgan Scenarios:

- $120–130/barrel: Short-term supply shock

- $150–200/barrel: Prolonged closure or conflict escalation

Inflation Risk

A closure could push U.S. inflation back toward 5%, forcing the Fed to reconsider rate hikes — a direct hit to the disinflation narrative.

Sector & Asset Class Impacts: What to Watch When Markets Open

Winners:

- Energy stocks (oil & gas producers, pipelines, refiners)

- Volatility trades (VIX derivatives, long volatility strategies)

- Inflation-linked bonds (TIPS, break-even rate plays)

- Commodities (gold, oil, copper)

- Defense contractors (due to potential global military buildup)

Losers:

- Emerging markets with high energy import dependence

- Transportation and airline stocks (fuel cost pressure)

- Rate-sensitive assets (bonds, high-growth equities) if inflation fears reignite

- Europe and Asia (particularly vulnerable to energy shockwaves)

Beyond Oil: A Global Macro Risk Story

This crisis transcends crude oil. A Strait of Hormuz closure would represent a global shock with cross-asset implications:

- Supply chain disruptions across petrochemicals, LNG, and refined fuels

- Pressure on global central banks to re-evaluate easing plans

- Shift in geopolitical alliances, especially between OPEC members and U.S./China

- Increased military risk premium in sovereign debt and EM currencies

In essence, this is not just a Middle East oil story — it’s a global macro pivot point.

Prepare for Volatility Amid Rising Geopolitical Risk

The potential closure of the Strait of Hormuz isn’t just a Middle East issue — it’s a global risk factor with widespread implications for energy security, financial markets, and geopolitical stability. Whether you're a trader, investor, or policymaker, the message is clear: stay informed, stay agile, and hedge against uncertainty.

For real-time updates, expert analysis, and strategic market insights during volatile events like this, follow the professionals at Global Gold and Currency Corporation — your trusted source for navigating global financial storms.